📊 Trading Workflow

WATA follows a systematic process to handle trading signals and execute trades. This workflow ensures reliability, consistency, and proper risk management.

Signal to Execution Flow

-

Signal Reception

- Validate incoming webhooks (authentication, token verification)

- Parse action type (long, short, close)

- Extract and validate required fields (indice, timestamps)

-

Rule Validation

- Verify market hours (trading only during configured hours)

- Check timestamp freshness (reject stale signals)

- Validate allowed indices (only trade configured indices)

- Apply daily profit limits (stop trading if daily goal reached)

-

Trade Execution

- For new positions:

- Search for optimal instrument based on configured parameters

- Calculate order size based on account balance and risk settings

- Place order and confirm position creation

- For closing positions:

- Retrieve current position details

- Create closing order

- Calculate and report performance metrics

- Position monitoring:

- Continuous position performance tracking

- Automatic stop-loss/take-profit handling

- For new positions:

-

Performance Tracking

- Daily statistics generation

- Performance metrics reporting

- Database storage for analysis

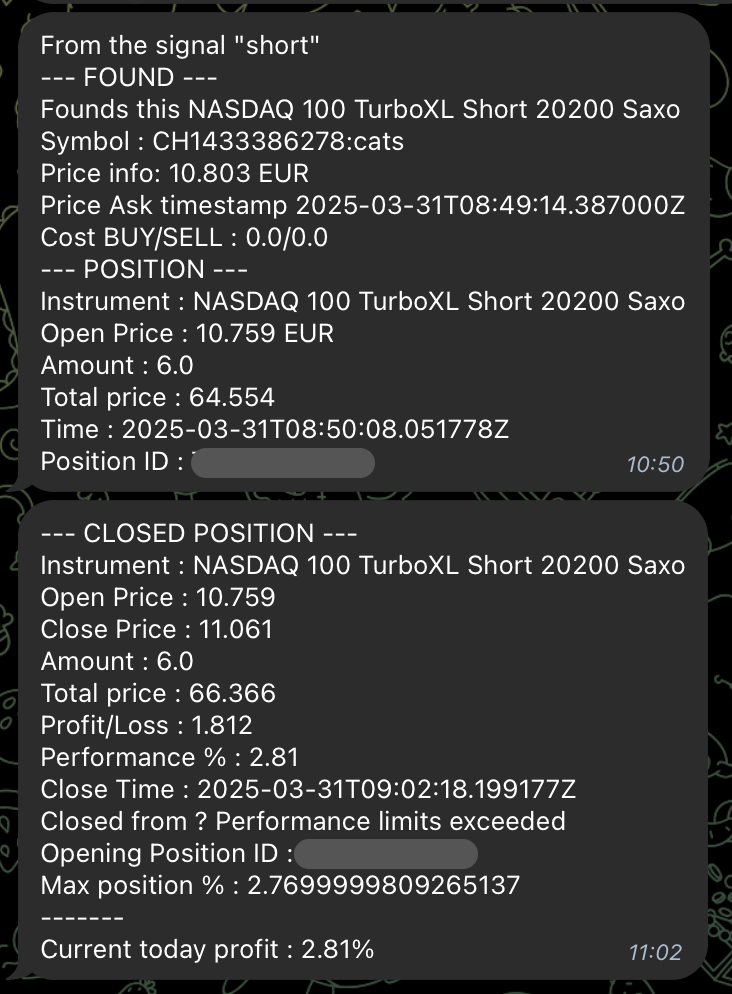

Example Notification Flow

WATA sends detailed notifications via Telegram at each step of the trading process:

Webhook Configuration

To interact with WATA, send trading signals to:

POST /webhook?token=YOUR_SECRET_TOKEN

With a payload like:

{

"action": "long",

"indice": "us100",

"signal_timestamp": "2023-07-01T12:00:00Z",

"alert_timestamp": "2023-07-01T12:00:01Z"

}

Available actions:

long: Open a long positionshort: Open a short positionclose-position: Close the current position

The indice must match one of the allowed indices configured in your config.json file.